insurance cover for boats

rcr warns of sub standard insurance cover

Breakdown and emergency assistance firm, River Canal Rescue (RCR), is calling for boaters to check their terms & conditions if they have a third-party insurance policy, as many will leave them unable to recover costs for a vessel refloat, removal and pollution management if their boat sinks.

RCR says it’s aware of a number of insurance companies that are capitalising on the demand for cheap policies by modifying their terms & conditions, including removing some common third-party risks or adding them as optional extras.

This, says managing director, Stephanie Horton, is causing major problems for owners, who due to unclear Policy Information Documents, are unaware they’ll be left to foot the bill for vessel refloat, pollution management and environmental damage claims, should their vessel sink:

“While most third-party policies will support ‘salvage’ – vessel sinking – claims, as there’s a risk you may cause damage to the environment and other vessels, do not take this for granted. Boat age is another issue; although a standard policy covers specific age-ranges, insurers can exclude certain vessels, or will only insure with a survey, not a BSS certificate, so it’s important to check.”

RCR is also concerned about claims handling, saying a number of insurers fail to appreciate boaters’ circumstances or support them during what is usually a very traumatic event.

Stephanie continues: “The emphasis is generally on claimants to limit further damage, organise estimates, report on what’s happening and pay for the work. Most insurers don’t take into account if you’re on holiday, you cannot progress the claim as you would if at home, and if you’re a liveaboard, and have just lost everything including your bank cards, phone and personal possessions, you’re not in a position to take any of the above actions.

“Before buying insurance, check the policy exclusions and optional extras, and ask how your claim will be processed if your vessel sinks or is at risk of sinking - is there a 24 hour helpline and online support?”

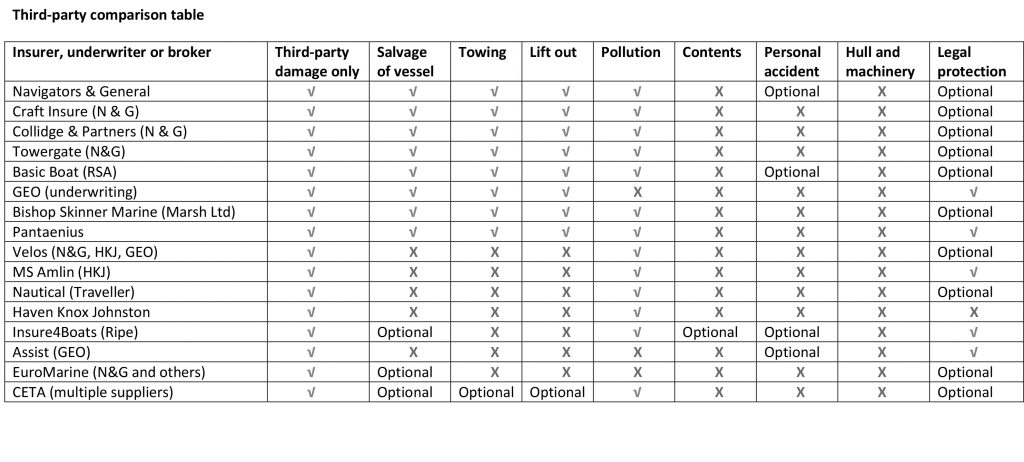

To help boaters navigate third-party policies and claims handling procedures, RCR has compiled two insurer comparison tables. Where possible its team checked all available policy documents, but this may not cover everything, so use only as a framework. Similarly, the claims handling data is based on general claims, and each case may be different.

RCR and its subsidiary, Canal Contracting, respond to hundreds of incidents resulting in insurance claims every year and regularly witness insurance policies failing to meet customer expectations and variations in insurer claims handling. Its Incident Care team helps boaters manage insurance claims and reduce risks following an emergency – call 01785 785680 to find out more.

RCR and its subsidiary, Canal Contracting, respond to hundreds of incidents resulting in insurance claims every year and regularly witness insurance policies failing to meet customer expectations and variations in insurer claims handling. Its Incident Care team helps boaters manage insurance claims and reduce risks following an emergency – call 01785 785680 to find out more.