insurance claims handling under fire

could your claim be denied?

In 2023, River Canal Rescue (RCR) warned boat owners about third-party ONLY insurance policies and how ambiguous wording could leave them unable to recover costs for a vessel refloat, removal and pollution management if their boat sinks.

It’s not just third-party policy wording however, that’s under fire; RCR highlights that even when you’ve done everything correctly, you can still end up in a situation where your claim is denied.

RCR and its subsidiary, Canal Contracting, respond to hundreds of incidents resulting in insurance claims every year, and there’s growing alarm over the high number of cases where it could be argued that claims are unfairly rejected.

Managing director, Stephanie Horton, comments: “In addition to insurance companies removing common third-party risks or adding them as optional extras, essentially downgrading their cover, we’re witnessing some heart-breaking cases, where insurers are rejecting claims from people with fully comprehensive cover, leaving them to cover salvage costs and unable to replace their homes or possessions.

“In most cases owners have been responsible, obtained surveys and undertaken all work identified, but can end up still being penalised for issues they were unaware of.”

Lost everything

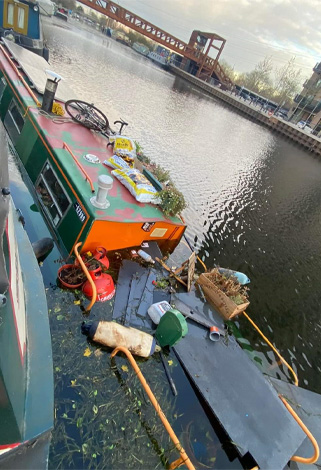

Keith Gray from Manchester and partner, Niall Senior, bought 52ft narrowboat Wind Whistle in November last year. The modified boat had no engine, the original empty steel hull was welded to a new steel cabin superstructure, the inside of the steel shell had been spray-foamed and cabin spaces refitted.

During its survey, the surveyor made a series of pre-purchase recommendations, such as adding skin fittings and valves, blocking up un-used holes in the stern and fitting bilge alarms and pumps, which the sellers agreed to rectify.

The buyers opted to insure with the boat’s existing insurers, reasoning the insurer would know its history and modifications. They left the boat Christmas Eve to visit family, and on Boxing Day, during a period of storms, the boat sank.

Having messaged their insurer, Keith and Niall were offered no help re salvage or finding temporary accommodation, so they contacted RCR who organised the salvage and provided support/advice.

After the boat was raised, the insurer’s surveyor said the rebuilding and fitting out works had been undertaken without adequate care and attention to acceptable boat building practices and construction standards, and reported the boat ‘not fit for purpose’.

Key contributors to the sinking were identified as:

• The domestic water tank and water system pipework had not been installed and secured in an appropriate manner or with the right material.

• There was no, or a significant lack of, ballast beneath the cabin floorboards, negatively impacting the boat’s stability, and the cabin floorboards were laid and secured in such a way they cannot be lifted to allow the retrospective installation of ballast in the underlying bilge.

• Weight was added high up without appreciating the effect this might have on the boat’s stability. Thick/heavy tiles and timber were affixed and used to line the cabin sides and deck heads and a very large wall-mounted mirror was affixed to the cabin side in the saloon.

• Hull openings were incorrectly configured and an inappropriately blanked-off out-of-use skin fitting was left through the hull, close to the waterline, suggesting a lack of appreciation of the impact this may have on seaworthiness in general.

• The plastic skin fittings were not fitted with a valve and therefore open/unsealed, and proprietary skin fittings were not in place in the two openings in the port hull topsides, adjacent to the galley sink.

• There were no bilge pumps or alarms fitted and the openings were not watertight.

The surveyor said these issues should have been flagged up to the insurer, yet Keith and Niall were either unaware of them or believed they had been put right.

The insurer rejected the claim, citing: the insured failed to comply with the surveyor’s recommendations, the vessel was not maintained for the use intended and it was in a poor condition, causing water incursion which was not sudden, unforeseen or accidental (which they would cover).

Having used their life savings for the boat, the couple now have no home, money or possessions, and the insurer even declined to pay for the lift-out and towing away of the boat.

Their insurer offered to refund Keith and Niall the policy premium, if they accepted the terms of the declination (which they haven’t) and advised them to sue the sellers/ pre-purchase surveyor via their legal expenses cover (which they are).

Keith, a creative director, and Niall, a musician, are trying to return Wind Whistle to a live-able condition and have set up a Go Fund Me page so they can pay a joiner to re-fit the boat.

A heart-breaking case

Lily Goodwin bought her 36ft springer narrowboat Stortford Rose in September 2020, during lockdown, continuously cruising in the London area.

The pre-purchase survey showed up a few amber flags, but nothing critical, and Lily undertook all the work highlighted in the survey. Crucial to her claim, the surveyor said the gas locker coatings were beginning to breakdown due to age (recommending the locker is thoroughly descaled and protective coatings applied), but he did not say the gas locker coatings were holed.

Similar to Keith and Niall, Lily went with her seller’s insurer – thinking it would keep things simple.

In November 2021, Lily double-moored her boat on the River Lea, London, and went to stay at her boyfriend’s for the weekend. While away there was a storm and the boat sank. After contacting her insurer, RCR attended to refloat it.

The insurer’s surveyor reported: ‘RCR stated the weed hatch was very loose and they suspected that had been the source of the ingress. The freeboard was measured at 12 - 13cm with the gasket found in good condition, so it was not confirmed this was the cause. The rudder stock tube, stern gland, gas locker and through-hull penetrations were inspected but with access restrictions due to detritus and personal possessions, no obvious cause could be identified.'

Having confirmed the boat was beyond repair and with no obvious sinking cause, the surveyor said he would sign off the sinking and Lily’s claim would be paid.

Stortford Rose sank again two days later. RCR believes this was due to the theft of the bilge pump it installed, preventing water being pumped out as it drained into the bilges, coupled with heavy rainfall.

After being raised, Lily felt the second visit from her insurer’s surveyor was less positive. He appeared to spend less time inspecting the boat and asked for more contents evidence. Lily’s possessions, including equipment, electrical items and the bilge pump/battery RCR installed, had been stolen.

Having conceded the first sinking was due to the storm and water entering the gas locker through the drain and possibly from above (which Lily believes would have been covered), in his second report the surveyor concluded ‘the vessel sank because water entered the gas locker, which was holed through corrosion, allowing water to enter the engine compartment. This happened on both occasions. Had the gas locker been in good condition, it is likely that it would have contained the water. The extent and severity of the corrosion was not identified in the survey report, commissioned by the insured’.

The claim was rejected, citing negligence, yet it was due to an issue Lily was unaware of as it hadn’t been picked up by her pre-purchase surveyor. Lily was also left to pick up the second salvage, lifting and transporting cost which was over £3,500.

After the boat was taken out of the water, Lily asked for a second independent survey - he found the hull was very thin, half the hull thickness reported by the first surveyor – and said if the boat had been hit once raised, it would let water in.

Despite sharing her evidence with the insurer, the claim was still rejected.

Lily, a freelance art-fabricator involved in prop making, didn’t take out legal expenses cover and cannot afford the legal fees to take things further. She has now sold her boat to someone who will refurbish it.

Distressing

Stephanie concludes: “It is important that owners do their own checks and ask questions, make sure you are fully informed. Gas locker issues make up a large proportion of rejection of claims so is always worth checking these areas periodically. These cases are very distressing, and it is concerning that claims are being denied when a survey has not picked up a problem. If customers take all the precautions and actions outlined in a survey – having instructed a professional to provide guidance – how can they be held responsible for not knowing about an issue that is then relied upon to reject a claim? Unfortunately, the cases detailed are only the tip of the iceberg.”